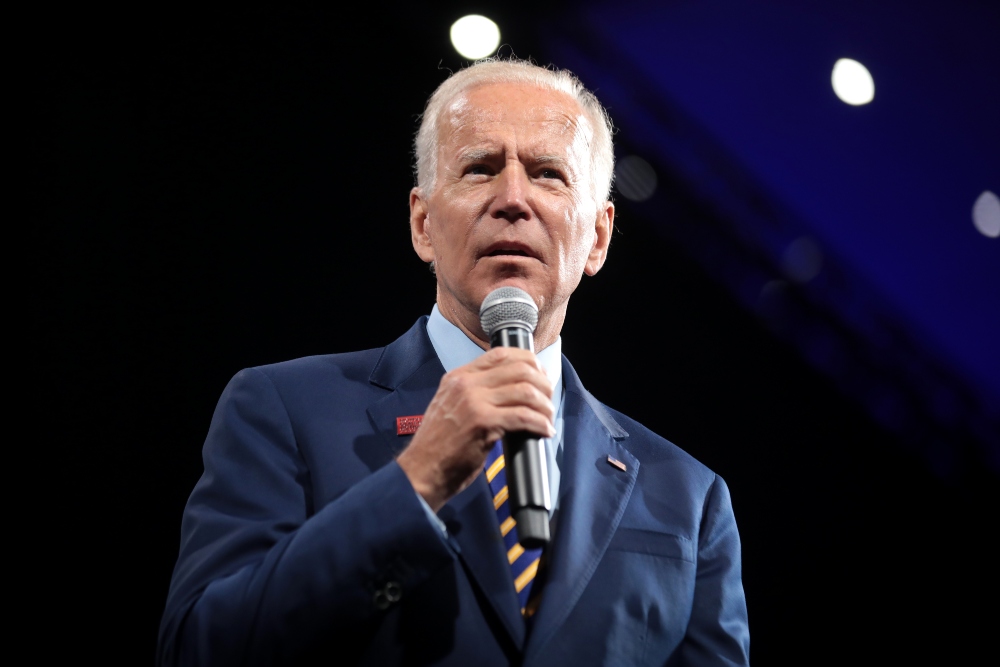

Education officials under the Trump administration are pushing back against former President Joe Biden’s student loan forgiveness program, which they say will be phased out in the coming weeks. They also criticized private universities for what they described as a “greedy” sense of entitlement that has fueled a broken and unsustainable higher education funding model.

Fox News anchor Dana Perino summed up the administration’s stance on Fox & Friends Tuesday, stating that “the gravy train is over” for bloated, bureaucratic university systems that have relied on the federal government to supply unlimited funding to students while steadily raising tuition rates. “Remember, it was Nancy Pelosi who said, ‘Wait a minute, Joe Biden doesn’t have the legal authority to do this,’” Perino said during the segment, a reference to a series of legal setbacks suffered by the former president when his executive orders were successfully challenged in court. “They had false hopes, false promises to people.”

Perino added that she sympathizes with those who have unaffordable loans, but that shouldn’t absolve them of their obligation to taxpayers. “It doesn’t mean that the system couldn’t be changed or that the interest rate can’t be lowered, but they are going to have to pay it back,” she said. Meanwhile, Education Secretary Linda McMahon defended the Trump administration’s decision this week to resume student loan collections after years of extended pauses. On Monday, the Department of Education announced it would begin contacting 5.3 million borrowers who have fallen into default due to the prolonged suspension of payments.

Both President Biden and university administrators made “empty promises to students while pocketing their loan dollars,” McMahon wrote in a fiery Wall Street Journal op-ed this week. “Colleges and universities call themselves nonprofits, but for years they have profited massively off the federal subsidy of loans, hiking tuition and piling up multibillion-dollar endowments while students graduate six figures in the red,” she wrote.

“A widely cited 2015 study found that for every dollar of increased federal caps on subsidized loans, colleges raised tuition by 60 cents,” she continued. “Many of the degree-granting programs that qualify for student loans are worthless on the job market, but colleges continue to accept students to these programs and encourage them to borrow to pay for them.” Student loan relief was first introduced during the initial Trump administration as a temporary response to the COVID-19 pandemic. However, it has since evolved into a politically charged issue that has been cautiously debated but largely left unresolved, even as outstanding balances have continued to grow for most borrowers.

McMahon blasted Biden for dangling “the carrot of loan forgiveness in front of young voters” during his 2020 campaign, even though he knew he “never had the authority to forgive student loans across the board.” The Biden administration’s resulting student loan repayment delays and subterfuge have racked up a “massive debt that is now long past due.”

“I am announcing the end of this dishonest and irresponsible policy. We will conform the department’s repayment options to federal court decisions and end the Biden-era practice of zero-interest, zero-accountability forbearances that are pushing borrowers into loan delinquency and default,” she wrote. “On May 5, we will begin the process of moving roughly 1.8 million borrowers into repayment plans and restart collections of loans in default. Borrowers who don’t make payments on time will see their credit scores go down, and in some cases, their wages automatically garnished.”

“Why? Not because we want to be unkind to student borrowers. Borrowing money and failing to pay it back isn’t a victimless offense. Debt doesn’t go away; it gets transferred to others. If borrowers don’t pay their debts to the government, taxpayers do,” McMahon added.