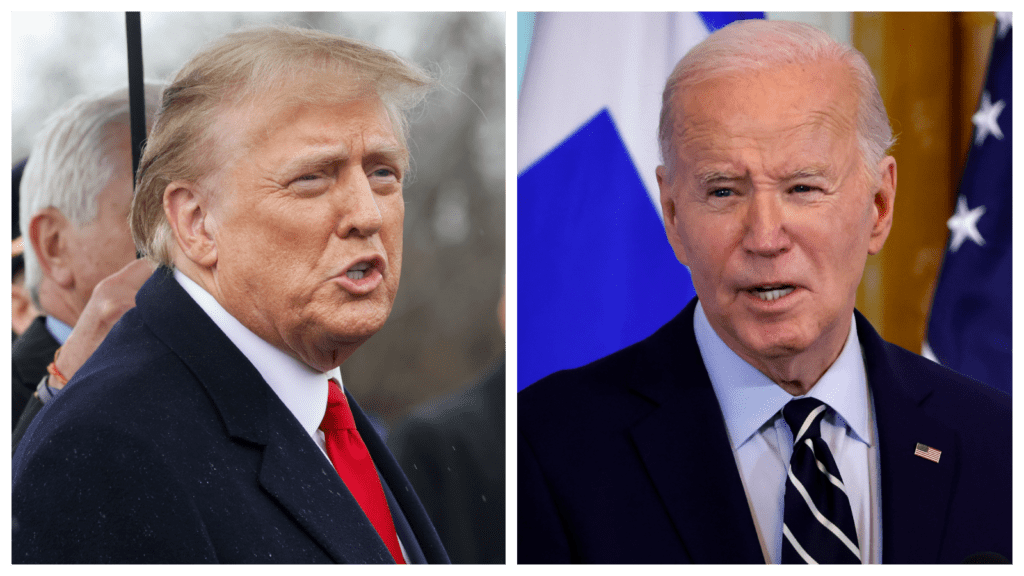

President Joe Biden may be serving his last days in government before permanently retiring from public life, but he’s leaving President-elect Donald Trump a big mess on his way out. Inflation rose for the second consecutive month, ticking up by 0.1 percentage point to 2.7% for the year ending in November, according to the Bureau of Labor Statistics’ consumer price index update released Wednesday. The increase in inflation poses a challenge for President-elect Donald Trump, who is set to inherit the economy from President Joe Biden. It indicates that the price pressures that plagued the nation during Biden’s presidency have not yet been fully resolved.

Month-to-month inflation saw an increase of 0.3%, the Washington Examiner reported. Inflation was a central issue during the campaign and played a significant role in Trump’s victory over Vice President Kamala Harris last month. Core CPI inflation, which excludes the more volatile categories of food and energy, held steady at 3.3% for the year ending in November. Rising inflation likely means the Federal Reserve will be less anxious to lower interest rates.

Federal Reserve officials are closely monitoring inflation data to decide whether to further lower interest rates to stimulate economic activity or hold off on rate cuts to curb inflation. Following the election, the Fed lowered its interest rate target by a quarter of a percentage point. The Fed’s long-term goal is to maintain annual inflation at 2%. The Fed also considers the personal consumption expenditures (PCE) index when making policy decisions. The latest October data revealed that PCE inflation rose to 2.3%, while core inflation increased to 2.8% yearly, the Examiner reported.

Despite relatively high interest rates, the labor market has remained resilient, though there are signs of gradual cooling. In November, the economy added 227,000 jobs, while the unemployment rate ticked up by 0.1 percentage point to 4.2%, according to the Bureau of Labor Statistics. This followed a surprising October report, which initially showed only 12,000 jobs added—a figure later revised to 36,000, still reflecting slower growth.

Trump will take office with a labor market that remains resilient, albeit showing signs of slowing. Examining the broader labor market trend provides additional context. The three-month moving average of job gains increased to 173,000 in November, surpassing the pace required to keep up with population growth. Trump will also inherit an economy characterized by robust growth but with core prices for everyday goods and services needed by most Americans far higher than they were when he left office in 2021.