A new analysis of 2019 U.S. consumer prices revealed that the costs of imported goods decreased despite the implementation of import tariffs by then-President Donald Trump. A 2024 report from the Coalition for a Prosperous America examines the impact of Chinese exports to the United States, finding that these exports lowered prices rather than increased them.

“Since the Section 301 tariffs were imposed, the share of imports from China has steadily declined from 21.6% in 2017 the year prior to the tariffs to 16.5%, a decline of 5.1%. No other country has lost as much share of total U.S. import penetration over the past five years,” the group’s report said.

“In terms of total import value, Mexico gained the most from the tariffs, adding $110.8 billion. Vietnam gained the second most in import value by $78.4 billion and by far gained the most of total share of U.S. imports. In 2017, Vietnam accounted for about 2% of U.S. imports at $46.5 billion,” the report continued. “In 2022, the U.S. imported $127.5 billion in goods from Vietnam, and the share of the total nearly doubled to 3.9%. Other countries in Southeast Asia such as Thailand, Cambodia, and Indonesia all saw significant increases in their value of imports by the U.S.”v

The Conservative Treehouse noted of the study’s findings:

With the 2024 election rapidly coming, it is worth revisiting the actual tariff outcome to American consumers in order to dispel the popular myths about tariffs raising prices here at home. This might be the cited data you want to bookmark.

It was the Fourth Quarter of 2019…..Right before the pandemic would hit a few months later, despite two years of doomsayer predictions from Wall Street’s professional punditry, all of them said Trump’s 2017 steel and aluminum tariffs on China, Canada and the EU would create massive inflation – it just wasn’t happening!

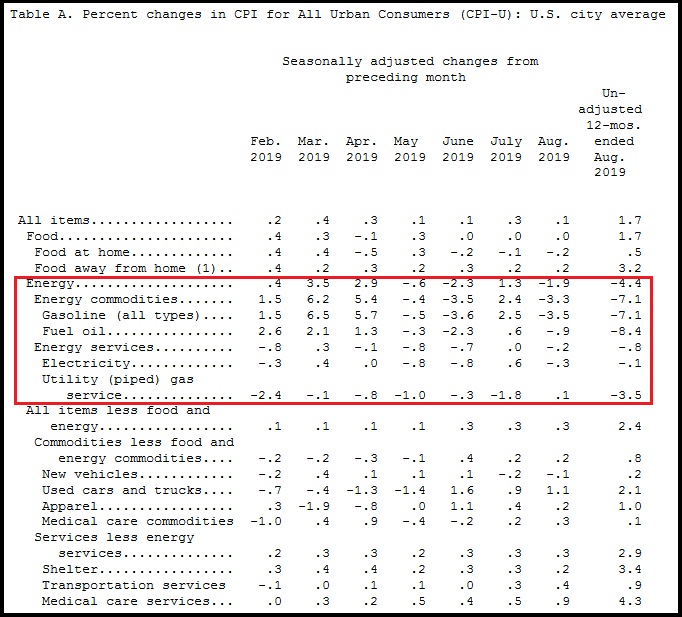

Overall, year-over-year inflation remained around 1.7 percent. In the latter half of 2019, the inflation rate stabilized, showing fewer month-to-month fluctuations and maintaining consistency. The U.S. economy was on a steady growth trajectory—strong and stable–and with Main Street thriving under MAGAnomics, the analysis found.

There are two key points to consider. First, President Trump’s America First MAGAnomics initiative focused on revitalizing the energy sector to reduce overall costs for consumers and boost industrial output. Lower energy prices benefit the working economy, the middle class, and the average American more significantly than any other sector. Secondly, food prices experienced very low year-over-year inflation at just 0.5 percent. This stability is attributed to two main factors: reduced energy costs and the weakening of Big Agriculture’s control over farm production and export dynamics.

For the past twenty years, Big Agriculture (Big Ag) has increasingly controlled food prices, overriding the natural forces of supply and demand. The Conservative Treehouse explained that the commodity market became a “controlled market,” with U.S. farm production being managed and exported to maintain optimal prices for American consumers. President Trump’s trade reset disrupted this arrangement. With fewer farm products being exported, supermarket food prices realigned with a more typical supply and demand cycle. As a result, food prices dropped, lowering the cost of groceries for consumers.

Disclaimer: This article may contain commentary.