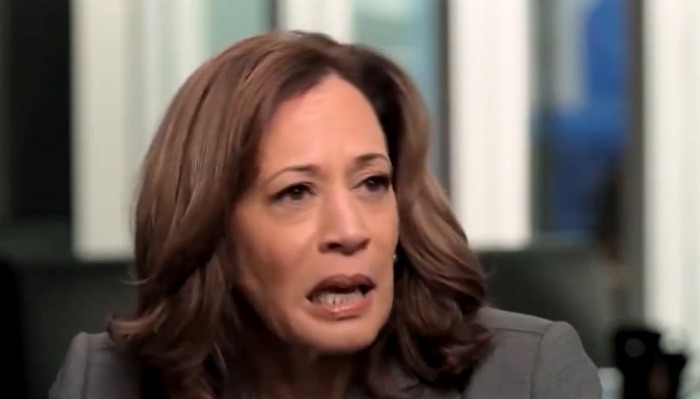

In a Friday interview with 6ABC Philadelphia’s Action News, Vice President Kamala Harris was asked about her plans to make life more affordable for Americans. However, her response veered off course into a lengthy discussion about her middle-class upbringing and the significance of well-maintained lawns. When anchor Brian Taff inquired about her strategies to improve affordability, Harris instead reminisced about her childhood, highlighting her mother’s hard work and the aspirations of her community. She particularly emphasized the symbolic value of well-kept lawns without providing specific details on her policy proposals.

“I’ll start with this. I grew up a middle-class kid. My mother raised my sister and me. She worked very hard, she was able to finally save up enough money to buy our first house when I was a teenager. I grew up in a community of hardworking people, you know, construction workers and nurses and teachers,” Harris told Taff. “I tried to explain to some people who may not have had the same experience, you know, a lot of people will relate to this. You know, I grew up in a neighborhood of folks who were very proud of their lawn, you know. And I was raised to believe and to know that all people deserve dignity. And that we as Americans have a beautiful character.”

Eventually, Harris introduced the concept of an “opportunity economy” designed to support small business startups. However, she did not provide details on how this plan would be implemented or the specific strategies involved. “So when I talk about building an opportunity economy, it is very much with the mind of investing in the ambitions and aspirations and the incredible work ethic of the American people and creating opportunity for people, for example, to start a small business,” the VP continued.

WATCH:

Kamala details her plan to bring down prices (which are up 20.3% since she took office):

“I grew up in a neighborhood of folks who were very proud of their lawn. Ya know?” pic.twitter.com/XbRpRHaLKs

— Trump War Room (@TrumpWarRoom) September 13, 2024

In August, inflation fell to its lowest level since February 2021, according to a Labor Department report released Wednesday. However, a key inflation measure came in higher than anticipated, suggesting the Federal Reserve might implement a quarter percentage point rate cut, handing more bad economic news to the Biden-Harris administration. The consumer price index, which tracks the cost of a wide range of goods and services across the U.S. economy, rose by 0.2% for the month, matching the Dow Jones consensus forecast, as reported by the Bureau of Labor Statistics. Overall, however, prices remain much higher than when then-President Donald Trump left office.

?SINCE HARRIS TOOK OFFICE

Gas: +46.1%

Electricity: +30.7%

Fuel oil: +43.4%

Airfare: +21%

Hotels: +49.4%

Groceries: +21.5%

Baby food: +29.5%

K-12 food: +66.2%

Rent: +22.5%

Transportation: +32%

Car insurance: +54.9%

Overall inflation: +20.3%

Real average weekly earnings: -3.4%— Jacki Kotkiewicz (@jackikotkiewicz) September 11, 2024

“That put the 12-month inflation rate at 2.5%, down 0.4 percentage point from the July level, slightly below the estimate for 2.6% and at its lowest level in 3½ years,” CNBC reported. “However, the core CPI, which excludes volatile food and energy prices, increased 0.3% for the month, slightly higher than the 0.2% estimate. The 12-month core inflation rate held at 3.2%, in line with the forecast. The slight uptick in core CPI keeps the Fed on defense against inflation, likely negating the probability of a more aggressive interest rate when policymakers meet next Tuesday and Wednesday.”

Seema Shah, chief global strategist at Principal Asset Management, told CNBC: “This isn’t the CPI report the market wanted to see. With core inflation coming in higher than expected, the Fed’s path to a 50 basis point cut has become more complicated. The number is certainly not an obstacle to policy action next week, but the hawks on the committee will likely seize on today’s CPI report as evidence that the last mile of inflation needs to be handled with care and caution – a formidable reason to default to a 25 basis points reduction.”