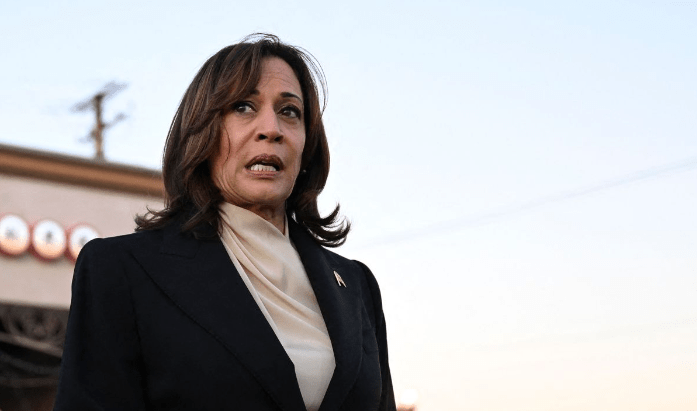

Conservative economists are expressing skepticism about Vice President Kamala Harris’s latest proposal to lower startup costs for small businesses, part of her “Opportunity Economy” economic platform. Last week, Harris introduced new tax proposals intended to ease the financial burden of starting a new business. One of the key elements is a significant increase in the standard tax deduction for small-business startup costs, raising it from $5,000 to $50,000. “It’s essentially a tax cut for starting a small business,” the vice president said during a stump speech announcing the new proposal. “We’re going to help more small businesses and innovators get off the ground.”

At the same time, Harris has voiced support for increasing marginal tax rates for both corporations and individuals. Economists argue that these proposed tax hikes could offset the benefits of the substantial increase in the startup deduction, Fox News reported Friday. “She wants to increase taxes on all kinds of income, on all classifications of income, so no matter how the small business is ultimately structured, they will still be paying more,” economist E.J. Antoni told Fox News Digital. “Now, is that going to be diminished by this increase in the tax deduction? Absolutely. But, then, why are you doing both? That doesn’t make any sense.”

Under the Trump administration, standard deductions were increased and marginal tax rates were lowered, Antoni noted. Additionally, Trump’s tax cut measures allowed small business owners to claim a deduction for their “qualified business income.” The decision on whether to extend any of Trump’s expiring tax cuts will ultimately be made by Congress. On Thursday, Trump addressed the Economic Club of New York, where he proposed lowering the corporate tax rate from its current 21% to 15%, down from the previous 35% rate before his first-term tax cuts. “Harris wants to do the opposite [of Trump],” Antoni said. “She wants to increase the deduction, but then increase the marginal tax rates.”

Robert Wolfe, a Harris supporter and former chairman of UBS Americas, emphasized that the proposed increase in tax rates for individuals will only affect those earning over $400,000. “We want small businesses being built,” Wolfe said. “And we know that the ramp-up phase takes time, and so the idea that we wouldn’t applaud small businesses and entrepreneurs getting tax credits doesn’t make sense to me.”

Richard Stern, director of the Grover M. Hermann Center for the Federal Budget at The Heritage Foundation, told Fox that current tax laws already allow new business owners to deduct most early-stage expenses, such as payroll and equipment costs. He explained that startup expenses, as defined by the tax code, are costs incurred before a business is registered with the federal government, and these are generally quite minimal. “Harris’ new tax deduction for small businesses isn’t a subsidy for starting a business per se,” he said. “It’s only useful if you actually spend $50K on pre-business expenses. So, this is disproportionately a subsidy for larger starting businesses.”

Stern concurred with Antoni’s view that Harris’s proposal appears to give to small businesses with one hand while taking away with the other. Antoni also criticized the Harris campaign’s economic policy formulation, likening it to “building the train as it goes down the tracks.” He added: “It really seems like there were no policy proposals thought out ahead of time, and they are just throwing these things together.”

In addition to Harris’ new tax proposals for small businesses, she also laid out her plan this week for taxing capital gains. She wants to increase it to 33%, whereas Biden reportedly wants the current rate, which is at 23.8%, to be nearly doubled, according to The Wall Street Journal. Raising this tax, experts say, will dampen investment and ultimately hurt the value of existing companies while hindering growth for others, harming the economy in general.