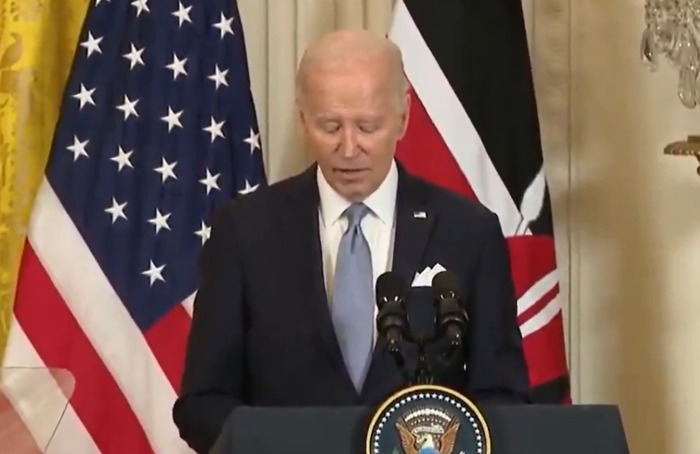

President Joe Biden has been hit with a double whammy of bad news following a horrific week for his campaign on the heels of a terrible debate performance against former President Donald Trump.

For one, the vast majority of middle-income Americans are reporting difficulties in maintaining their financial status amid prolonged periods of high inflation in the U.S. Nearly two-thirds say they are falling behind economically due to the rising cost of living, Fox Business reports, citing data from the Primerica’s Financial Security Monitor (FSM) survey for the second quarter of 2024, which polled more than 1,000 U.S. adults with incomes between $30,000 and $130,000.

Between June 8 and 11, 66% of survey respondents indicated that their income was not keeping pace with their cost of living, and 48% reported either reducing expenses or ceasing to save money in order to manage their finances. This trend aligns with findings from the National True Cost of Living Coalition, which revealed that 65% of Americans earning around 200% above the national poverty line—approximately $62,300 for a family of four, a benchmark often associated with the middle class—are experiencing financial difficulties.

Primerica’s analysis highlighted a significant transformation in the financial behaviors of middle-income families, revealing that 80% have shifted towards preparing more meals at home over the past year instead of dining out or ordering takeout. The primary reason 72% of respondents reduced their dining out was due to budget concerns. Additionally, 62% mentioned “unreasonably high” restaurant prices as a key factor influencing their decision to cut back, the firm said.

“Middle-income families are continuing to make adjustments in their budgets in an attempt to manage the ongoing high cost of living,” said Glenn Williams, CEO of Primerica. “Unfortunately, their difficult decisions include the increasing use of credit cards and scaling back saving for the future, which both could negatively impact their long-term financial condition.”

Many households have experienced an increase in monthly expenses due to ongoing inflation. While the consumer price index has decreased from its peak of 9.1%, it still remains significantly higher than pre-pandemic levels. Since January 2021, before the sharp rise in prices began, inflation has increased by more than 18%, the report said. Grocery prices are up more than 21% from the start of 2021, and shelter costs are up 18.37%, according to FOX Business calculations. Energy prices are up 38.4.%.

Fox Business added:

Grocery prices are up more than 21% from the start of 2021, and shelter costs are up 18.37%, according to FOX Business calculations. Energy prices are up 38.4.%. The typical U.S. household needed to pay $227 more a month in March to purchase the same goods and services it did one year ago because of still-high inflation. Americans are paying on average $784 more each month compared with the same time two years ago and $1,069 more compared with three years ago.

Meanwhile, the unemployment rate rose again from 4 percent to 4.1 percent after the economy only added about 220,000 jobs. This follows the closely watched ADP report which showed companies added 150,000 jobs last month, missing the 160,000 gain that economists surveyed by Refinitiv predicted and down from the revised 157,000 figure in May. These economic indicators are closely monitored by the Federal Reserve, which will use them to determine the timing of the anticipated rate-cutting cycle. Chairman Jerome Powell, in a statement earlier this week, emphasized the necessity for lower inflation before proceeding with rate cuts.

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing, how tight our policy is,” he said during remarks at the European Central Bank Forum. “Market watchers are currently pricing in the first-rate cut at the September meeting, according to the CME’s FedWatch Tool, which tracks the probability of rate moves,” Fox Business noted.