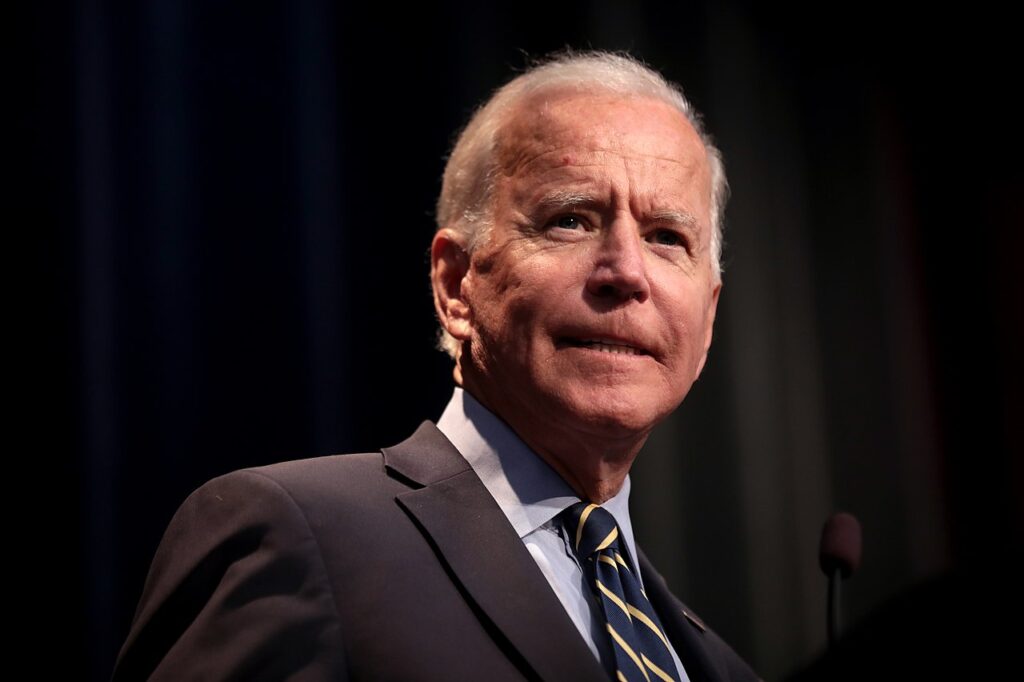

The U.S. Supreme Court has torpedoed Joe Biden’s scheme to transfer an estimated $430 billion in student loan debt to taxpayers – without getting their approval.

Now one analyst suggests it’s going to toss his strategy for a wealth tax under the bus, too.

A report in the Washington Examiner explained that Thomas Berry, research fellow at the Cato Institute, said the 16th Amendment is at issue.

“The Sixteenth Amendment allows the federal government to impose income taxes without apportioning them among the states,” he said. “But courts have always limited those taxes to that word, ‘income,’ and said that word is meaningful. It doesn’t just mean whatever the government wants it to mean.”

Biden’s plan is to impose taxes on people for income they don’t get.

The report explained, “Whether unrealized capital gains can be considered income has long been a subject of debate among scholars. Berry suggests that Biden and other Democrats could instead try to raise taxes on traditional income, which he is also seeking to do, as well as through measures such as tariffs on foreign goods.”

But Biden repeatedly has touted the idea of a “billionaire tax” that he wants to collect.

The case, to be heard by the court in just a few months, revolves around Charles and Kathleen Moore of Washington state. They had invested about $40,000 in a company in India, and although it made a profit, they never got a single payment.

They were then handed a bill for a $14,729 repatriation tax.

They paid it and sued.

They charged that Constitution allows Congress to “lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states.”

Under the plain understanding of the words, “That means that the federal government cannot tax stock gains, which are the source of wealth for many billionaires unless those stocks are sold,” the report explained.

The Supreme Court took the case up after a lower court approved the taxation method.

Biden, during an address to Congress, demanded his “billionaire minimum tax.”

He has suggested a 25% annual tax on all gains to wealth in excess of $100 million. That would include taxes on any increase in the value of a stock, even if the income never is received.

Berry said while nothing is certain when pending before the Supreme Court, “I think the justices will be concerned about setting a new precedent here and opening the door to a lot of taxes that we’ve never seen before at the federal level.”