While Democrats rail about ‘Trump family corruption’ that so far, no court of law or district attorney has been able to find or successfully prosecutor, they ignore the very real corruption of the current first family.

What’s more, they cheer the federal institutions protecting them.

Originally published by WND News Center. Used with permission.

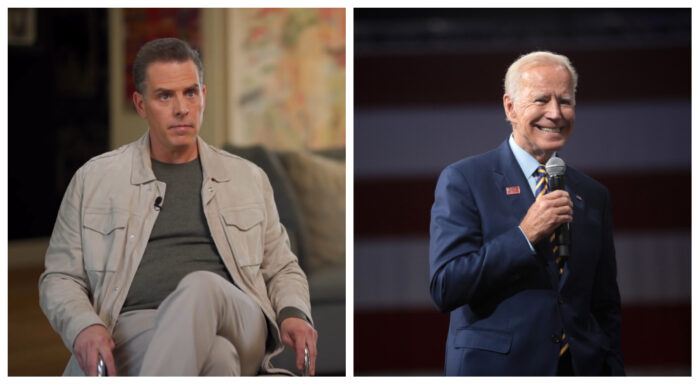

A whistleblower says that because of special protections provided Hunter Biden by members of the Department of Justice he hasn’t – and won’t ever have to – pay taxes on some $400,000 in income.

It was IRS supervisory agent Gary Shapley who explained the situation in an interview with Just the News.

He said it absolutely was special treatment that was given Hunter Biden.

“If these facts were from the local businessman or the neighbor next door, they would have been charged, they would have already probably had their entire sentence,” he said during the John Solomon Reports podcast.

He said “the injection of political influence” into an investigation of income Hunter Biden took, and the taxes he paid, meant that a special counsel twice was refused permission to file appropriate charges and let the justice system take over.

He explained, the consequence is that Hunter Biden still hasn’t – and won’t have to ever – pay the overdue taxes on the Ukrainian business deal.

The income was from Ukrainian gas company Burisma, which was paying him tens of thousands of dollars a month to be on its board.

Those taxes, Shapley said, still are “outstanding, and because, you know, 2014-15, was denied by the D.C. U.S. attorney. And then David Weiss requested special counsel authority and didn’t get it. And then they allow that statute of limitations to expire, even though defense counsel had signed extensions on that previously. There is no legal remedy to go and get that money unless he does so voluntarily.”

Federal prosecutors, in fact, recently announced a special deal for Hunter Biden: They would throw out possible felony tax charges for some alleged failures to pay in return for his guilty pleas to a couple of misdemeanors.

And they’d forget about a felony gun case if he accepted a “diversion” program.

That, Hunter Biden defenders have said, closes down the whole scenario.

Shapley explained in the interview that federal agents had evidence that Hunter Biden was in the middle of a “pretty classic tax evasion scheme.”

The total income thought to have been involved appears to be in the range of $8 million, he suggested.

Just the News explained, “Shapley, and a second IRS whistleblower whose name has not been released, rocked Washington earlier this month when they told the House Ways and Means Committee that Justice Department engaged in significant political interference in Hunter Biden’s tax cases that thwarted agents from getting search warrants, interviewing witnesses and ultimately bringing the serious felony charges that career prosecutors believed were warranted against President Joe Biden’s son.”

Estimates are that Hunter Biden failed to pay more than $2 million in taxes when due.

Shapley explained the Burisma issue: “If you’re specifically talking about Burisma, for 2014, there was conservatively $400,000 in unreported Burisma income on his income tax returns. And, you know, that was around $120,000 to $125,000 in tax withholdings as a result of that failure to report that income.”

At the time, agents “signed off on a plan to charge Hunter Biden with multiple felonies to include the Burisma monies from 2014, but when Delaware U.S. Attorney David Weiss, the lead prosecutor, asked his colleagues in Los Angeles and Washington, D.C., to secure an indictment he was turned down. And then the statute of limitations was allowed to expire for the earlier offenses,” he said.

He called it an obvious “injection of political influence.”