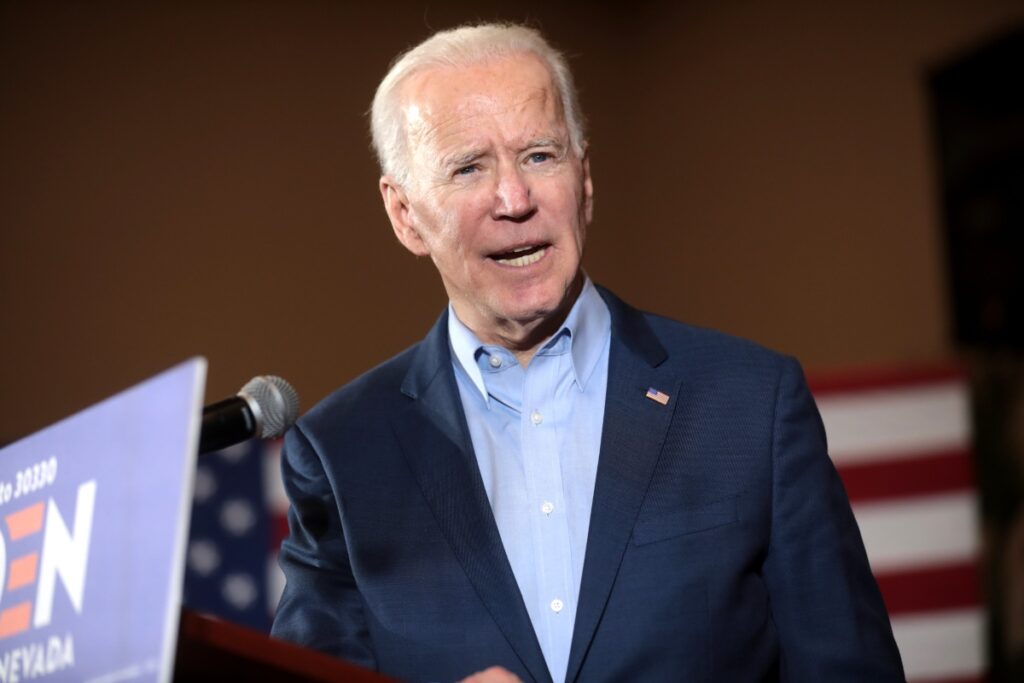

Joe Biden is announcing a new plan that would force good-credit mortgage borrowers, those who have worked hard to establish credit-worthiness by borrowing and repaying, and borrowing and repaying, to subsidize risky borrowers.

Originally published at WND News Center. Used with permission.

It is the Washington Times that understated, perhaps, that the scheme “punishes” homebuyers with high credit scores and homeowners seeking to refinance.

The new fees are going to hit American consumers in just days, on May 1.

“The changes do not make sense. Penalizing borrowers with larger down payments and credit scores will not go over well,” Ian Wright, of Bay Equity Home Loans in San Francisco, told the Washington Times. “It overcomplicates things for consumers during a process that can already feel overwhelming with the amount of paperwork, jargon, etc. Confusing the borrower is never a good thing.”

The report explained the “costly surprise” for American consumers, at a time when mortgage rates under Joe Biden’s policies already have doubled, or even tripled, from when he took office, will force those with good credit to pay up to let those with “riskier credit ratings” buy homes.

Biden is forcing the change through the Federal Housing Finance Agency, and the bureaucracy has labeled the stunt “Loan-level price adjustments.”

The report explained that homebuyers with credit scores of 680 or higher will pay at least $40 a month more on a home loan of $400,000.

“Homebuyers who make down payments of 15% to 20% will get socked with the largest fees,” the report explained.

Wright explained the changes being demanded do not come from “folks that understand the entire mortgage process.”

The problem is compounded by the Federal Reserve that has been pushing interest rates higher and higher, so mortgages now are well above 6%. That’s because inflation under Biden’s policies hit a scorching 9.1% last summer, and still remains almost triple the goal.

Biden’s scheme provides “lower down payments” and “discounted fees” for those who are less qualified to make a home purchase, the report said.

Mortgage Bankers Association President Bob Broeksmit was not a fan of Biden’s strategy, calling the fee changes “especially troubling.”